Renters Insurance in and around Houston

Looking for renters insurance in Houston?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your rented property is home. Since that is where you relax and spend time with your loved ones, it can be advantageous to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your smartphone, silverware, books, etc., choosing the right coverage can insure your precious valuables.

Looking for renters insurance in Houston?

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

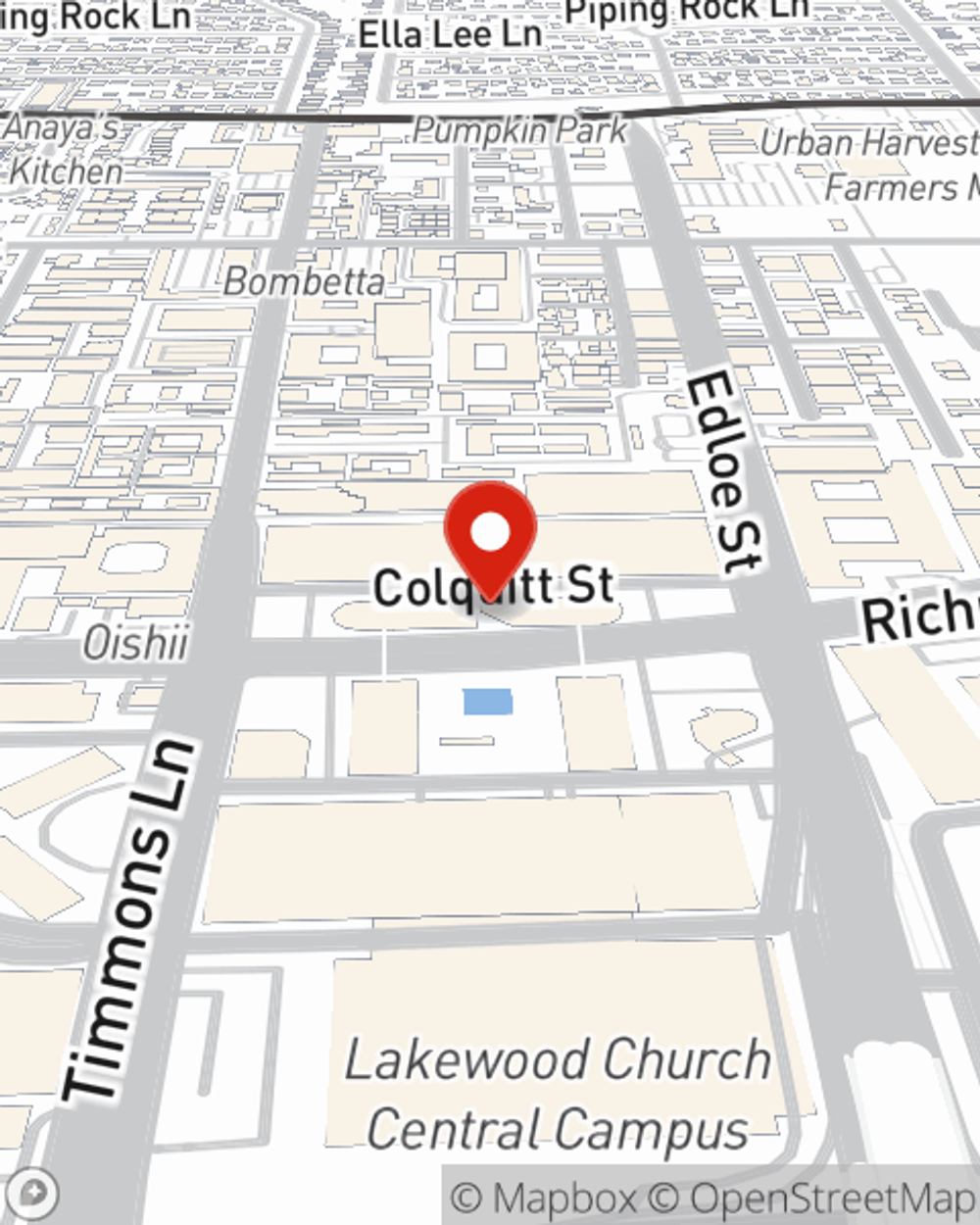

It's likely that your landlord's insurance only covers the structure of the condo or townhome you're renting. So, if you want to protect your valuables - such as a microwave, a bedding set or a coffee maker - renters insurance is what you're looking for. State Farm agent Martin Melkonian is dedicated to helping you understand your coverage options and protect your belongings.

Get in touch with Martin Melkonian's office to find out the advantages of State Farm's renters insurance to help keep your belongings protected.

Have More Questions About Renters Insurance?

Call Martin at (281) 712-2788 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Martin Melkonian

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.